1. What is an ESOP?

ESOPs, or Employee Stock Option Plans, are like giving employees a piece of the company they work for. Employees get shares of the company’s stock for free or at a discount. Under an ESOP, companies allocate a certain number of shares to be held in trust for employees. These shares are then distributed to employees over time, typically based on criteria such as years of service or job performance.

Components of an ESOP:

- Shares: A share, in financial terms, represents ownership in a company. When you own shares of a company, you own a portion of that company. Employees get a part of Ownership of the Company as part of the ESOP plan.

- Vesting: This means employees have to fulfill certain conditions like work for the company for a certain amount of time before they fully own the shares.

- Trust: An ESOP trust, or Employee Stock Ownership Plan trust, is a legal entity established to hold and manage shares of company stock on behalf of employees participating in an Employee Stock Ownership Plan (ESOP).

- Administrator: An ESOP Administrator is typically a designated individual or entity responsible for overseeing the management and administration of an ESOP within a company.

- Valuation: ESOP valuation refers to the process of determining the fair market value of a company’s shares held within an Employee Stock Ownership Plan (ESOP). ESOP valuations are typically conducted by independent valuation firms or professionals with expertise in business valuation.

2. What is ESOP Cost Accounting?

- Calculating Cost: The company calculates how much it will spend to give employees shares through ESOPs, considering factors like the number of shares and their value.

- Allocating Cost: Instead of spending all the money upfront, the company spreads out the cost over time. For example, if employees get shares over four years, the cost is divided into four parts.

- Recording Expenses: Each year, the company records part of the ESOP cost as an expense on its books. This helps show how much the company is spending on employee benefits each year.

- Keeping Track: By doing ESOP cost accounting, the company can keep track of how much it is spending on ESOPs and make sure it is managing its finances wisely.

Overall, ESOP Cost Accounting helps companies plan and manage their expenses related to employee ownership programs like ESOPs in a simple and organized way.

3. What are the methodologies for ESOP Cost Accounting?

Black-Scholes: The Black-Scholes-Merton (BSM) model is a pricing model for financial instruments. It is used for the valuation of stock options. The BSM model is used to determine the fair prices of stock options based on six variables: volatility, type, underlying stock price, strike price, time, and risk-free rate.

Binomial: The binomial option pricing model is a risk-free method for estimating the value of path-dependent alternatives. With this model, investors can determine how likely they are to buy or sell at a given price in the future. It assumes that stock prices follow a binomial distribution. This means that, over discrete time intervals, the stock price can move in two possible directions, either up or down.

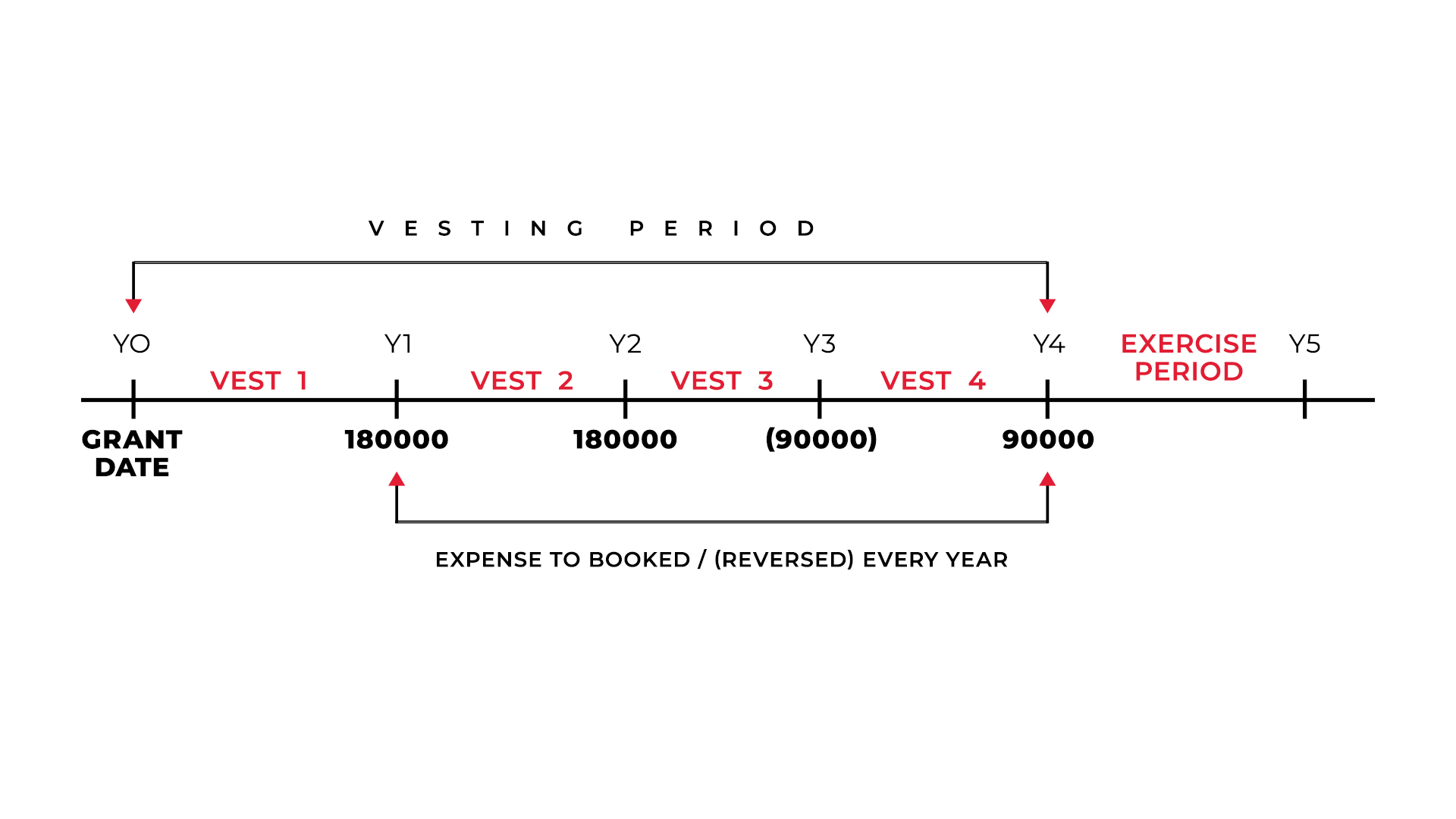

Let us understand the accounting of ESOPs through an example –

P Ltd. granted options for 8000 equity shares of nominal value of Rs. 10. at Rs. 80 when the market price was Rs. 170.

The Vesting period is 4 years.

4000 unvested options lapsed due to termination of employees in Year 3.

3000 options were exercised during the exercise period.

1000 vested options lapsed at the end of the exercise period.

Exercise period is for 1 year.

As per the information provided above pass the required Accounting Entries for each year including the narrations for each journal entry.

Expense to be recognized every year of Vesting –

Year 1:

Accounting Entries:

| Year 1 | Expense Booked | In Rs. (Dr.) | In Rs. (Cr.) |

|---|---|---|---|

| Employee Benefit Expense A/c Dr. | 1,80,000 | ||

| To Share-Based Payment Reserve A/c | 1,80,000 | ||

| (Yearly Expense Booked) | |||

| Profit & Loss A/c Dr. | 1,80,000 | ||

| To Employee Benefit Expense A/c | 1,80,000 | ||

| (Employee Benefit Expense transferred to P&L) |

Calculation –

| No. of Options | Expense to be Booked | Analysis |

|---|---|---|

| 8,000 | No. of Options * (Market Price – Exercise Price) * 1/4

((8,000 * 90 * 1/4) – 0) = 1,80,000 |

This is the expense to be recorded in Year 1 |

Year 2:

Accounting Entries –

| Year 2 | Expense Booked | In Rs. (Dr.) | In Rs. (Cr.) |

|---|---|---|---|

| Employee Benefit Expense A/c Dr. | 1,80,000 | ||

| To Share-Based Payment Reserve A/c | 1,80,000 | ||

| (Yearly Expense Booked) | |||

| Profit & Loss A/c Dr. | 1,80,000 | ||

| To Employee Benefit Expense A/c | 1,80,000 | ||

| (Employee Benefit Expense transferred to P&L) |

Calculation –

| No. of Options | Expense to be Booked | Analysis |

|---|---|---|

| 8,000 | No. of Options * (Market Price – Exercise Price) * 2/4 – Expense recorded till date

((8,000 * 90 * 2/4) – 1,80,000) = 1,80,000 |

This is the expense to be recorded in Year 2 |

Year 3:

Accounting Entries –

| Year | Expense Reversed due to lapsed unvested options | In Rs (Dr.) | In Rs (Cr.) |

|---|---|---|---|

| Year 3 | Share-Based Payment Reserve A/c Dr. | 90,000 | |

| To Employee Benefit Expense A/c | 90,000 | ||

| (Excess Expense booked earlier is reversed) | |||

| Employee Benefit Expense A/c Dr. | 90,000 | ||

| To Profit & Loss A/c | 90,000 | ||

| (Employee Benefit Expense transferred to P&L) |

Calculation –

| No. of Options | Expense to be reversed | Analysis |

|---|---|---|

| 4,000 | No. of Options * (Market Price – Exercise Price) * 3/4 – Expense recorded till date ((4,000 * 90 * 3/4) – 1,80,000 – 1,80,000) = (90,000) | This is the expense to be Reversed in Year 3 |

Year 4:

Accounting Entries –

| Year | Expense Booked | In Rs (Dr.) | In Rs (Cr.) |

|---|---|---|---|

| Year 4 | Employee Benefit Expense A/c Dr. | 90,000 | |

| To Share-Based Payment Reserve A/c | 90,000 | ||

| (Yearly Expense booked) | |||

| Profit & Loss A/c Dr. | 90,000 | ||

| To Employee Benefit Expense A/c | 90,000 | ||

| (Employee Benefit Expense transferred to P&L) |

Calculation –

| No. of Options | Expense to be Booked | Analysis |

|---|---|---|

| 4,000 | No. of Options * (Market Price – Exercise Price) * 4/4 – Expense recorded till date ((4,000 * 90 * 4/4) – 1,80,000 – 1,80,000 + 90,000) = 90,000 | This is the expense to be recorded in Year 4 |

Year 5:

Accounting Entries –

| Year | Exercise of Options | In Rs (Dr.) | In Rs (Cr.) |

|---|---|---|---|

| Year 5 | Bank A/c (3000*80) Dr. | 2,40,000 | |

| Share-Based Payment A/c Dr. | 2,70,000 | ||

| To Equity Share Capital A/c | 30,000 | ||

| To Securities Premium A/c | 4,80,000 | ||

| (Employees exercised the options) | |||

| Share-Based Payment Reserve A/c Dr. | 90,000 | ||

| To General Reserve A/c | 90,000 | ||

| (Excess Share Based Payment Reserve transferred to General Reserve) |