What is Goodwill?

Goodwill is an accounting term that arises when one company acquires another for a price higher than the fair market value of its identifiable assets and liabilities. This excess amount reflects the value of intangible factors that contribute to the business’s ongoing success, such as a strong brand, customer loyalty, intellectual property (IP), and employee expertise. These elements cannot be measured directly in financial terms but represent a significant source of future economic benefits.

Example:

For instance, when Apple acquires a smaller technology firm, the price often exceeds the sum of the firm’s tangible assets, reflecting Apple’s valuation of the firm’s expertise, innovative culture, or proprietary technology. This excess value is booked as goodwill in Apple’s financial statements.

Why is Goodwill Important?

Goodwill holds particular importance in various business contexts, especially in investment decisions and mergers and acquisitions (M&A). By evaluating goodwill, investors and acquirers can assess a company’s future growth prospects, hidden value, and market positioning. The presence of goodwill on a balance sheet also suggests a history of successful acquisitions, indicating strategic thinking and the ability to capture synergies.

- Moreover, goodwill plays a crucial role in financial reporting. Since goodwill is an intangible asset, it reflects the qualitative aspects of a company, providing a fuller picture beyond tangible assets.

- Strategic planning also relies on goodwill valuation, particularly during mergers, as it helps quantify the value of intangibles like brand power, customer relationships, and industry reputation.

- Goodwill is also essential for impairment testing under accounting standards, ensuring that companies do not overstate their asset values over time.

Key Components of Goodwill

1. Brand Value:

Brands that are recognized and trusted by customers create a significant advantage. Companies like Coca-Cola and Nike possess immense brand value, which allows them to charge premium prices and maintain customer loyalty. The ability to generate consistent revenue through brand power is a core part of goodwill.

2. Customer Relationships:

Customer loyalty and long-term relationships are valuable because they ensure a steady revenue stream. Companies like Amazon leverage strong customer relationships to drive repeat purchases. These relationships are often developed over years through superior customer service, personalized marketing, and maintaining trust.

3. Intellectual Property (IP):

Patents, trademarks, and proprietary technology offer competitive advantages. For example, pharmaceutical companies hold patents on life-saving drugs, creating exclusive rights that generate future cash flows. This ability to monetize IP adds significant value to a company’s goodwill.

4. Operational Efficiency:

Companies with well-optimized processes or a highly skilled workforce enjoy higher profit margins. Firms like Toyota, which is known for its lean manufacturing processes, are highly efficient, indirectly boosting their goodwill.

How is Goodwill Valued?

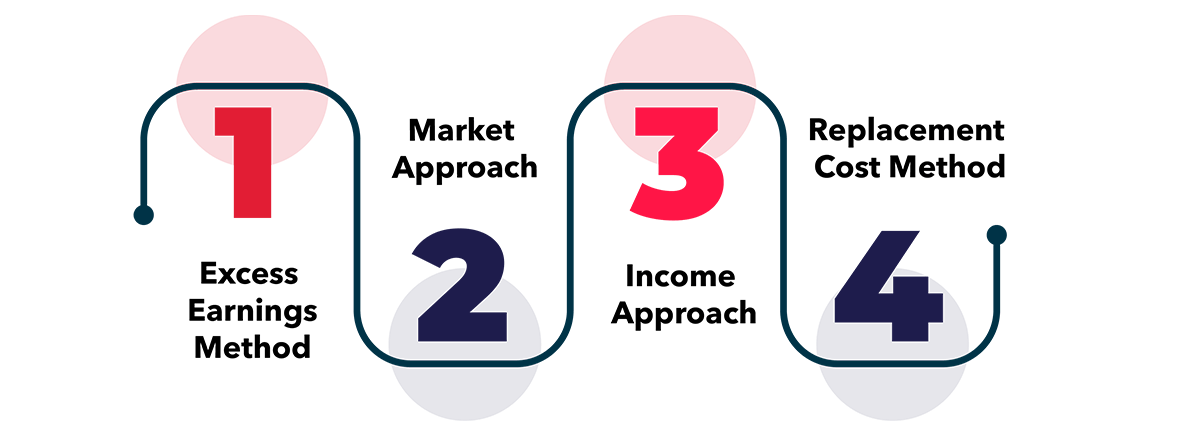

Goodwill is difficult to quantify directly, given its intangible nature, so various methods have evolved to capture its essence. Each method has its strengths and weaknesses, depending on the nature of the business being valued.

1. Excess Earnings Method:

This method involves identifying the “excess” earnings, which are those earnings beyond what is expected from the company’s tangible assets. Here’s a step-by-step breakdown of the calculation.

Example:

Imagine a consulting firm, ABC Consultants.

- Tangible assets are valued at ₹10 crore.

- The normal rate of return on tangible assets in the industry is 10%.

- The firm’s actual earnings are ₹1.8 crore annually.

Step 1: Calculate the earnings expected from tangible assets

Expected Earnings = ₹10 crore * 10% = ₹1 crore

Step 2: Identify the excess earnings

Excess Earnings = Actual Earnings – Expected Earnings = ₹1.8 crore – ₹1 crore = ₹0.8 crore

Step 3: Capitalize excess earnings to find goodwill

Assume a capitalization rate of 20% (risk-adjusted).

Goodwill = Excess Earnings / Capitalization Rate = ₹0.8 crore / 20% = ₹4 crore

Conclusion: The goodwill for ABC Consultants is ₹4 crore, calculated based on its excess profitability beyond the return expected from tangible assets.

2. Market Approach:

This method uses market data to compare the business being valued to similar companies that have recently been sold or traded. Goodwill is derived by comparing the premium price paid over book value in similar transactions.

Example:

Consider an acquisition of a software company, XYZ Tech. The recent acquisition of similar companies in the same industry shows:

- The average selling price of these companies is ₹15 crore.

- The average book value of these companies is ₹9 crore.

- XYZ Tech’s book value is ₹12 crore.

Step 1: Calculate the market goodwill multiple

Goodwill Multiple = (Selling Price – Book Value) / Book Value

Goodwill Multiple = (₹15 crore – ₹9 crore) / ₹9 crore = 0.67 or 67%

Step 2: Apply the multiple to the target company’s book value

Goodwill = Goodwill Multiple * XYZ Tech’s Book Value = 0.67 * ₹12 crore = ₹8.04 crore

Conclusion: Using the market approach, the goodwill for XYZ Tech is valued at ₹8.04 crore, based on market data from similar transactions.

3. Income Approach:

This approach involves estimating future cash flows and discounting them to their present value. Goodwill is represented as the present value of the excess income generated by intangible assets over a period.

Example:

Let’s take a luxury brand, “Elegance”, which expects to generate ₹5 crore annually in net cash flow for the next 5 years due to its strong brand recognition.

- Discount rate = 12%

- Assumed that without its brand goodwill, Elegance’s expected net cash flow would only be ₹2 crore annually.

Step 1: Estimate future cash flows from goodwill

Goodwill Cash Flows = Projected Cash Flows – Cash Flows without Goodwill

Goodwill Cash Flows = ₹5 crore – ₹2 crore = ₹3 crore annually for 5 years.

Step 2: Discount future goodwill cash flows to present value

Present Value (PV) of Goodwill Cash Flows =

Using the present value formula for each year:

- Year 1: ₹3 crore / 1.12 = ₹2.68 crore

- Year 2: ₹3 crore / 1.12² = ₹2.39 crore

- Year 3: ₹3 crore / 1.12³ = ₹2.14 crore

- Year 4: ₹3 crore / 1.12⁴ = ₹1.91 crore

- Year 5: ₹3 crore / 1.12⁵ = ₹1.71 crore

Total PV of Goodwill Cash Flows = ₹2.68 + ₹2.39 + ₹2.14 + ₹1.91 + ₹1.71 = ₹10.83 crore

Conclusion: The goodwill for Elegance is valued at ₹10.83 crore using the income approach.

4. Replacement Cost Method:

This method values goodwill by estimating how much it would cost to recreate the company’s intangible assets from scratch.

Example:

Consider an IP-heavy firm, ABC Software, which owns several proprietary software systems. The firm estimates the cost to develop and maintain these intangibles would be:

- R&D costs: ₹3 crore

- Licensing fees: ₹1 crore

- Training and recruitment of skilled professionals: ₹2 crore

- Marketing and brand-building efforts: ₹1.5 crore

Step 1: Sum up all costs

Replacement Cost = ₹3 crore + ₹1 crore + ₹2 crore + ₹1.5 crore = ₹7.5 crore

Conclusion: The goodwill for ABC Software is valued at ₹7.5 crore, which is the estimated cost to recreate its intangible assets.

Regulatory Framework

In India, goodwill valuation is subject to specific regulations under the Companies Act 2013 and Indian Accounting Standards (IND AS). These regulations ensure that goodwill is accurately reported, properly valued, and fairly presented in financial statements. Adhering to these guidelines is crucial to avoid overstatement of assets and maintain the reliability of financial reporting.

Key Regulations:

- IND AS 38 (Intangible Assets): This standard outline how intangible assets, including goodwill, should be recognized, measured, and disclosed in financial statements. Goodwill, being an intangible asset, must be recorded only if it is acquired in a business combination and not internally generated. IND AS 38 ensures that companies report goodwill appropriately, reflecting its fair value.

- IND AS 36 (Impairment of Assets): Goodwill is not amortized over time but is tested annually for impairment. IND AS 36 provides guidelines for conducting impairment tests, ensuring that if the carrying amount of goodwill exceeds its recoverable amount, the excess is written off as an impairment loss. This protects against inflated valuations on the balance sheet.

- Companies Act 2013: This act governs the accounting and financial reporting of Indian companies, including how goodwill should be recorded and presented. It ensures transparency and accountability in financial statements, especially in cases of mergers and acquisitions.

By adhering to these regulations, businesses ensure that their goodwill is reported accurately, avoiding inflated asset values, and maintaining compliance with legal and accounting standards. Regular impairment testing as per IND AS 36 is particularly crucial in industries where market conditions can rapidly change, safeguarding against goodwill overvaluation.

Example:

The regular impairment testing under IND AS 36 ensures that Tata Consultancy Services (TCS) accurately reports its goodwill. If TCS experiences a decline in brand value or customer retention, the value of its goodwill would be reduced, and the impairment would be reflected in the financial statements.

Real-World Examples

1. Tata Consultancy Services (TCS):

In 2020, TCS, one of India’s largest IT services firms, reported goodwill worth ₹58,000 crore. The company valued this goodwill using the Discounted Cash Flow (DCF) method, a widely accepted approach for projecting future earnings based on historical performance. TCS’s reputation, customer base, and operational efficiency contributed significantly to this figure.

Key Lesson:

This example illustrates how important regular goodwill impairment testing is to ensure that the value reflected on the balance sheet remains accurate, safeguarding the firm from future losses.

2. Flipkart’s Acquisition by Walmart:

In 2018, when Walmart acquired a majority stake in Flipkart for $16 billion, a significant portion of the purchase price was attributed to goodwill. Walmart’s valuation of goodwill was driven by Flipkart’s competitive positioning in the Indian market, its loyal customer base, and its potential for future growth.

Key Lesson:

In large acquisitions, goodwill often represents a strategic premium paid for future growth potential, emphasizing the need for accurate valuations during M&A processes.

3. HDFC Bank’s Acquisition of Centurion Bank of Punjab (2008):

In 2008, HDFC Bank acquired Centurion Bank of Punjab (CBoP) for ₹9,510 crore, and a substantial portion of this amount was attributed to goodwill. The goodwill was driven by Centurion’s extensive branch network, customer base, and growth potential in the Indian banking sector. HDFC Bank used the purchase price allocation method to assess the value of the acquired assets and goodwill.

Key Lesson:

This example highlights how goodwill can emerge from a strategic acquisition where synergies, such as access to a larger customer base and expanded geographical presence, are anticipated.

4. Reliance Jio’s Acquisition of Radisys (2018):

Reliance Jio acquired the US-based telecom solutions company Radisys for around $75 million in 2018. The acquisition provided Reliance Jio with Radisys’s technical expertise and talent in 5G, IoT, and other future technologies. Goodwill from this transaction was linked to Radisys’s intellectual property, employee know-how, and its ability to complement Jio’s telecom ecosystem.

Key Lesson:

Goodwill in this case emphasizes the value attributed to intellectual property and human capital, which are critical to driving future innovations and competitive advantage.

5. L&T’s Acquisition of Mindtree (2019):

When Larsen & Toubro (L&T) acquired a controlling stake in Mindtree, the transaction valued Mindtree at ₹10,000 crore. L&T’s acquisition led to a substantial goodwill figure on their balance sheet. The valuation of goodwill stemmed from Mindtree’s strong customer relationships, brand recognition, and future revenue growth potential in the IT services sector.

Key Lesson:

This acquisition showcases how a strong market position, reputation, and future business opportunities in the IT services industry can drive significant goodwill in M&A transactions.

Conclusion

Goodwill valuation goes beyond numbers—it captures the intangible strengths that set a company apart, such as brand reputation, customer loyalty, and intellectual property. Accurately valuing goodwill is crucial for investment decisions, mergers, and acquisitions, as it reflects the true potential of a business beyond its tangible assets. In acquisitions, goodwill often represents the premium paid for future growth, making precise valuation vital for fair transactions and strategic planning.

Moreover, goodwill must be regularly tested for impairment to ensure that businesses do not overstate their assets. This process maintains the integrity of financial reporting and avoids overvaluation risks. By using multiple valuation methods, validating assumptions, and staying updated with market trends and regulations, stakeholders can ensure their goodwill valuations are accurate and reflective of a company’s true worth. Mastering goodwill valuation leads to smarter investment choices and more informed business decisions.